straight life annuity with period certain

Examples of Five-Year Certain and Life Annuity in a sentence. Often a straight life annuity is purchased shortly before the annuitant wants regular payments to begin.

Annuity Payout Options Immediate Vs Deferred Annuities

Life income-period certain annuity.

. A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. If you die within a certain period after you begin receiving benefits usually 10 or 20 years your designated. A straight life annuity is a contract between an insurance company and the annuitant.

Life Plus Period Certain Annuity. Straight life annuities do not include a death benefit so payments cant be made to a beneficiary. Life with Period Certain.

If the annuitant dies before the guaranteed period has expired the payments can be passed to a beneficiary. Per annuity terminology life plus period certain describes an annuity option that guarantees that annuity payments will be paid for the retirees lifetime or a fixed amount of time whichever. Kuki Educalingo digunakan untuk memperibadikan iklan dan mendapatkan statistik trafik laman web.

If you pass away during the guaranteed period the rest of the payments will go to your beneficiary. Lihat butiran Faham. An insurance product that makes periodic payments to the annuitant until his or her death at which point the payments.

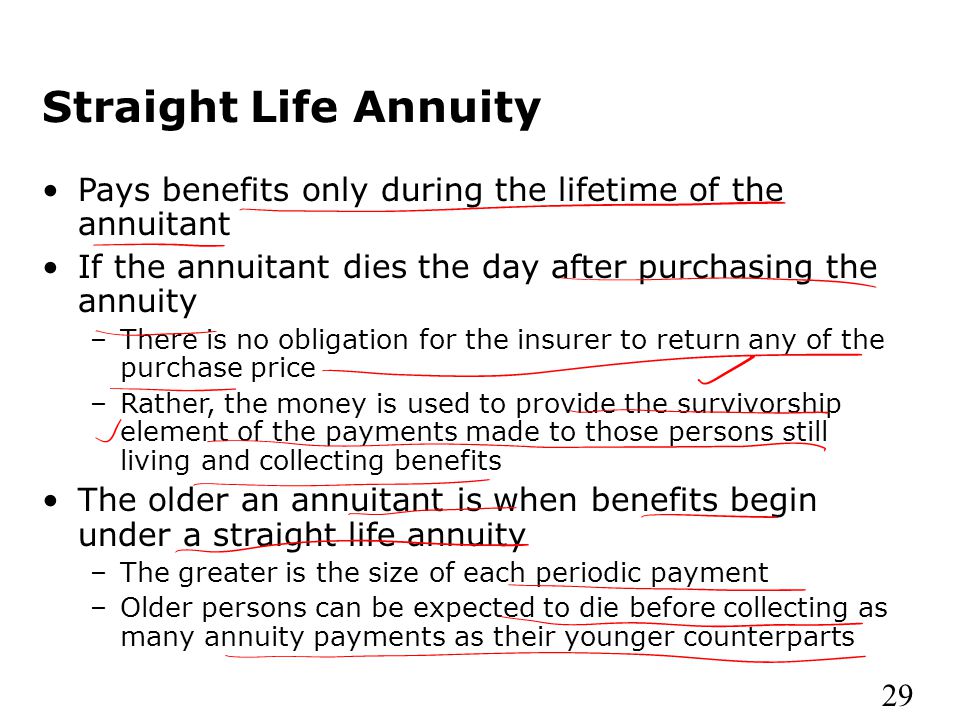

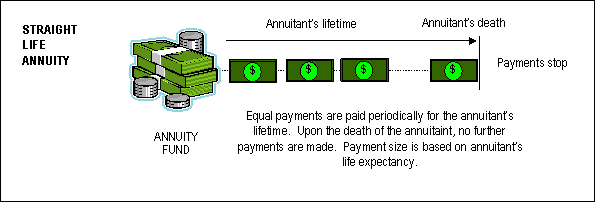

A 401k or IRA and Social Security benefits are the most common types of retirement income we think of when budgeting for the future. If you die before the period is fulfilled the payments will continue to your beneficiary for. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

The result is a faster growth of your account value. The annuity is provided for a set length of time typically 10-20 years during which your beneficiaries can receive benefits. So if you outlive this term you will receive no benefit.

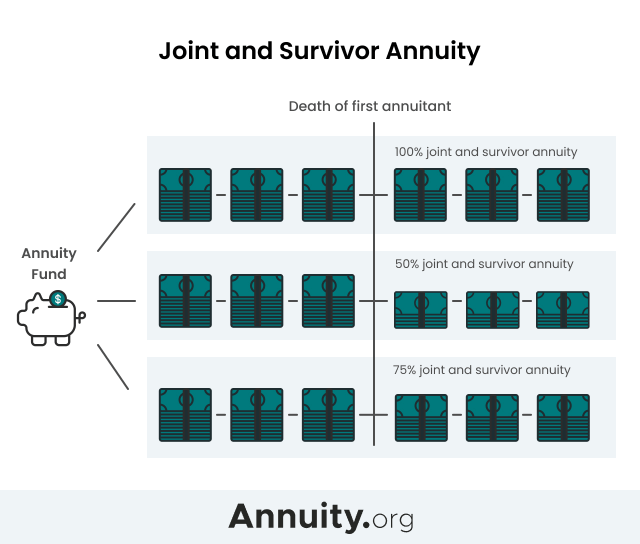

The benefit provided in Option 1 under Section 114a of the Plan provided however that the Member may elect a period certain of five years. Straight Life Annuity. Joint-life annuity payments are structured similarly to life-only.

So if you died after two years the insurance company would continue to make payments for another 8 years to your named beneficiary Of course because of this guarantee a lifetime. But it may not be a great choice for married couples. This differs from a pure life annuity where you receive payments for life regardless of how long you live.

Kami juga berkongsi maklumat tentang penggunaan laman web dengan media sosial pengiklanan dan rakan analisa kami. Straight life annuities do not include a death. A life-only annuity term will result in a higher monthly income payment than a joint-life term.

However there are several reasons why a straight life annuity deserves a closer look as a valuable part of your portfolio. If the annuitant outlives the 10 years of guaranteed payments then. These are most often used by couples.

A life annuity with period certain is a type of life annuity that allows you to choose when and how long to receive payments. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. With this option the company guarantees benefit payments for a specified number of years regardless of whether you die prior to the end of the benefit period.

A straight life annuity is tax-advantaged just as other annuities. Period certain is a life annuity option that allows the customer to choose when and how long to receive payments which beneficiaries can later receive. Five-Year Certain and Life Annuity.

Employees that rollover all or a portion of their Account under this Section 82e may elect from the payment options set forth under Section. The guaranteed period is often called the period certain and is frequently 10 or 20 years. Sinonim life annuity dan terjemahan life annuity ke dalam 25 bahasa.

A life annuity with period certain annuity is a contract that guarantees payments for an annuitants entire life along with a guaranteed period of time typically 5 to 20 years. A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. An annuity allows you to receive a regular amount over a fixed period of time or for the duration of your retirement.

If you die before the end of the specified period the company. February 7 2020. A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die.

Life Annuity with Period Certain As the name implies these annuities are similar to straight life annuities but they guarantee a specific time period for the income payments. A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. For example if you purchase a single-life annuity with a 20-year period certain and pass away 10 years later your beneficiary will collect income benefits for another 10 years.

A period certain annuity like a cash refund rider may deliver any remaining assets to your beneficiaries if you die unexpectedly. Because the payouts will be shorter in duration they offer the highest periodic payments. Life with Period Certain.

To receive the payments you have to buy the annuity. What Is A Straight Life Annuity Everything You Need To Know A life annuity with period certain is characterized as. Another option could be a period certain annuity.

What is a Life Annuity with Period Certain Annuity. A straight life annuity might not be the first financial product that comes to mind when planning for retirement. For example for a lifetime annuity with a 10-year period certain the insurance company promises to pay out for the rest of your life but no less than 10 years.

An annuity that guarantees a minimum number of payments even if the annuitant dies before the minimum amount is paid or a minimum number of payments plus income for life if the annuitant is still alive after the minimum amount is paid. If you die before the period of payments ends the remaining payments can be transferred to a spouse family member or other beneficiary. While a straight life annuity is tied to your lifespan period certain annuities pay out over a set amount of time regardless of how long you live.

The annuitant usually purchases the annuity with a lump sum deposit and the insurer promises to make a fixed regular payment to the annuitant for life. For example at 60 years old you buy an annuity costing 250000 and it will pay you a fixed amount of 1000 per month for the rest of your life. For example if you choose a 10-year period certain annuity and die within the 10-year period your beneficiaries would receive the remainder of the payments until the end of the period.

When Can You Cash Out An Annuity Getting Money From An Annuity

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download

Joint And Survivor Annuity The Benefits And Disadvantages

Annuities And Individual Retirement Accounts Ppt Video Online Download

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Providing Peace Of Mind In Your Retirement

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Life Annuity With Period Certain Trusted Choice

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

New York Life Annuity Guaranteed Future Income Annuity Ii

Metlife Annuity Immediate Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

Period Certain Annuity What It Is Benefits And Drawbacks